Contents:

The P/S ratio is also known as a sales multiple or revenue multiple. P/E ratio, or price-to-earnings ratio, is a quick way to see if a stock is undervalued or overvalued. And so generally speaking, the lower the P/E ratio is, the better it is for both the business and potential investors.

A P/E ratio, even one calculated using a forwardearnings estimate, doesn’t always tell you whether the P/E is appropriate for the company’s forecasted growth rate. So, to address this limitation, investors turn to another ratio called thePEG ratio. The price-to-earnings ratio can also be seen as a means of standardizing the value of $1 of earnings throughout the stock market. The forward P/E usesfuture earnings guidancerather than trailing figures. To determine the P/E value, one must simply divide the current stock price by the earnings per share . The P/E ratio is sometimes referred to as the “multiple.” For example, a P/E ratio of 15 means that investors are willing to pay $15 for every dollar of company earnings, for a multiple of 15.

An example of price-to-sales ratio analysis

It shouldn’t be used alone, and it shouldn’t be used to https://1investing.in/ companies that are in different businesses. That said, it is a handy way of seeing if a stock is a bargain or not. Let’s consider how we evaluate a firm that has not made any money in the past year. Unless the firm is going out of business, the P/S will show whether the firm’s shares are valued at a discount against others in its sector.

Steve is the Academic Dean for The London School of Wealth Management and has won many awards from Technical Analyst Magazine. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Now, I simply apply my 8.8 multiple to $4.6 billion to get a target market cap of $40.5 billion. Bite-size important facts and numbers about the markets, the world around us, and what it all means for you, written in simple language with a bit of humor. There are several varieties of EPS, depending on the additional elements in the calculation. Each of these can be used under different circumstances in a particular strategy.

Behavioral Equilibrium Exchange Rate (BEER)

A company with a high P/E ratio may be growing quickly and investors are willing to pay more for its shares. A company with a low P/E ratio may be in trouble and its shares may be undervalued. Like anything cheap, for instance a stock with low P/E value could be a bargain or a big disappointment. Wall Street Journal and other noted publications indicate the other measures like price-to-sales and price-to-cash-flow must be considered along with company history and economy strength.

Snapchat is the third most popular app among millennials and gets high profits from ads on the platform. Since TikTok is not available to invest in yet, Facebook is boring, we see Snap as a good choice to diversify your portfolio. We don’t know what keeps those kids so glued to screens in Snapchat but if companies profit from it, we can get a share thanks to investing in their stocks.

- While its utility as a stand-alone strategy is limited, it can be beneficial when used with other valuation techniques.

- It’s also the producer of the peanut butter JIF, kid’s all-time favorite filling.

- You shouldn’t compare P/E ratios of different kinds of companies, like a tech company and a consumer staple company.

- We help our clients to identify the right stocks, depending on portfolio, personal goals, and fundamental analysis.

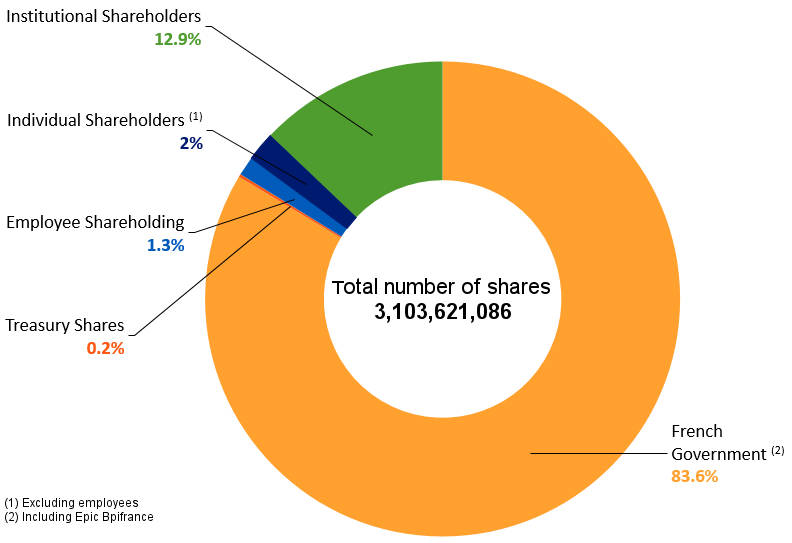

Performance over time and relation to peers are two useful practices to determine whether a P/S ratio is good or bad. The price-to-sales ratio (P/S ratio) tells you how much investors are willing to pay on a company’s ability to generate revenue. This is because investors are willing to pay a premium for quality and sustainable earnings. Price to sales ratio indicates how much investor paid for a share compared to the sales a company generated per share.

It is the what is a good p/s ratio value of the company’s assets that shareholders would theoretically get if the company were to wind up. For example, the P/S ratio is different across many industries, and it is often hard to compare companies in various sectors. The ratio cannot differentiate a leveraged company from an unleveraged one as a company can report a low P/S ratio and can be close to bankruptcy. As with all valuation techniques, sales-based metrics are only part of the solution.

How to Calculate the P/E Ratio

The ratio ignores two important financial health indicators – debt and profitability. If you’re unsure about how much money an investment could make, SmartAsset’s free investment calculator could help you get an estimate. The P/E ratio seems like a straightforward calculation, but what you use for earnings can be tricky. For one thing, earnings are reported by each company, and accounting practices are not the same across the board. There’s also the possibility that a company is inflating earnings by devaluing or hiding costs. For a trailing P/E ratio, the issue is that past performance doesn’t mean the same performance will be enjoyed in the future.

Should Value Investors Buy Avanos Medical (AVNS) Stock? – Nasdaq

Should Value Investors Buy Avanos Medical (AVNS) Stock?.

Posted: Thu, 02 Mar 2023 14:40:00 GMT [source]

That depends on a number of factors, including the overall market conditions and the specific industry. However, as a general rule of thumb, a P/E ratio below 15 is considered to be good value, while a ratio above 20 is considered expensive. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

Forward Price-to-Earnings

Price-to-Book Ratio is a financial indicator used as a part of fundamental analysis, a relatively good way to determine if the stock is undervalued, or selling at a premium. Typically, value investors consider a Profit-to-book value ratio below 1 to be an indicator of an undervalued stock. However, a P/B ratio of 3 is widely regarded as a standard for undervalued stocks. Traditionally, any value under 1.0 is considered a good P/B value, indicating a potentially undervalued stock.

Due to high-interest expenses, a company with a low Price to Sales ratio may be on the edge of bankruptcy. Carbon Collective is the first online investment advisor 100% focused on solving climate change. We believe that sustainable investing is not just an important climate solution, but a smart way to invest. InvestmentZen has financial relationships with some of the products and services mentioned and may be compensated if consumers choose to sign up for products through links in our content.

This could be a sign that the stock might be due to drop in value in the future. Besides raising capital in the stock market in exchange for ownership, a company may also take out loans to finance projects and investments. The P/S ratio doesn’t take into consideration the weighted average cost of capital — a weighted measure of the cost of capital from debt and equity sources. The WACC is a vital hurdle rate used to determine whether the return of an investment exceeds its cost or not.

You should consider whether you can afford to take the risk of losing your money. A good P/E ratio varies depending on factors such as type of industry and sector, but generally, ratios between are seen as acceptable. Ratios below 10 can indicate a possible bargain, while a ratio above 20 may indicate that the stock is expensive. Many investors prefer this valuation method because it is more objective; based on already recorded figures rather than predicted figures. Forward P/E ratio refers to a P/E ratio that is derived from projected future earnings.

Our Services

That’s why the P/E ratio continues to be one of the most centrally referenced points of data when analyzing a company, but by no means is it the only one. One primary limitation of using P/E ratios emerges when comparing the P/E ratios of different companies. Valuations and growth rates of companies may often vary wildly between sectors due to both the different ways companies earn money and the differing timelines during which companies earn that money.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Additionally, different industries can have wildly different P/E ratios (high-tech industries and startups often have negative or 0 P/E while a retailer like Walmart may have 20 or more). One limitation of the P/E ratio is that it is difficult to use when comparing companies across industries. Conventionally, however, companies will report such ratios as “N/A” rather than a negative value. If a company reports either no earnings for a period, or reports a loss, then its EPS will be represented by a negative number. The stock market fluctuates constantly, and so the price of a stock yesterday is not always a good indication of the price tomorrow.

The P/B ratio is currently near the Dotcom crisis levels, indicating an overvalued market, too. Even while the P/S ratio is less susceptible to accounting fraud, it is not impervious to it. To ensure that income is neither inflated nor underestimated in a period. Anderson is CPA, doctor of accounting, and an accounting and finance professor who has been working in the accounting and finance industries for more than 20 years. Her expertise covers a wide range of accounting, corporate finance, taxes, lending, and personal finance areas.

If the company belongs to an industry that is growing very slowly, a low P/E ratio would not be a disadvantage and possibly a reason for buying the stock. When you open the report, you will probably be amazed at the number of obscure lines you will see. The most important ones to look at are revenue, net income, EBITDA, and equity. A thriving company should be making profits, and its revenue, EBITDA, and equity should be growing.

Even if the company is making losses it has to be worth something as it has assets in its books, it is earning revenues and it has future prospects. One measure that is used in such cases is the Price to Sales ratio or the P/S ratio.. The P/E ratio helps investors determine the market value of a stock as compared to the company’s earnings. In short, the P/E shows what the market is willing to pay today for a stock based on its past or future earnings. A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued.

Even without a detailed comparison of ratios, you will get valuable information for your decision. An investor needs to evaluate how much of their risk is justified, as well as on which earnings and expenses they can count on. EPS is one of the essential indicators that help investors assess their risks and potential profits.

In a highly cyclical industry such as semiconductors, there are years when only a few companies produce any earnings. If a company’s earnings are negative, the P/E ratio is not optimal since it will not be able to value the stock because the denominator is less than zero. The trailing P/E relies on past performance by dividing thecurrent share priceby the total EPS earnings over the past 12 months. It’s the most popular P/E metric because it’s the most objective—assuming the company reported earnings accurately.

No responses yet